The economy of Germany, France and the Allied nations involved in World War II are in shambles. The only nation with a good economic standing was America. Before the attack on Pearl Harbour, America had maintained its stand as neutral by agreeing to supply military goods to the Allied nations. A good trade had emerged from the war. In their greatest strategic move they purchased huge tonnes of gold for their reserves. To foster economic growth and stability, in July 1944 the Bretton Woods agreement was signed. Gold was identified as a safe haven which ensured liquidity and zero degradation in value. The agreement said that all the currency in the World will be pegged against US dollars at the exchange rate of $35. And the dollars were pegged against the US gold reserves. Thus gold became the greatest asset in the world and US dollars became the most powerful currency.

In the late 1960s, the dollar outflow was huge because of the Vietnam War. It became difficult to peg dollars against gold. In 1971 President Nixon suspended the gold standard, the world called this event as ‘Nixon Shock’. It gave the Federal Reserve autonomy on the monetary policy and introduced floating exchange rates.

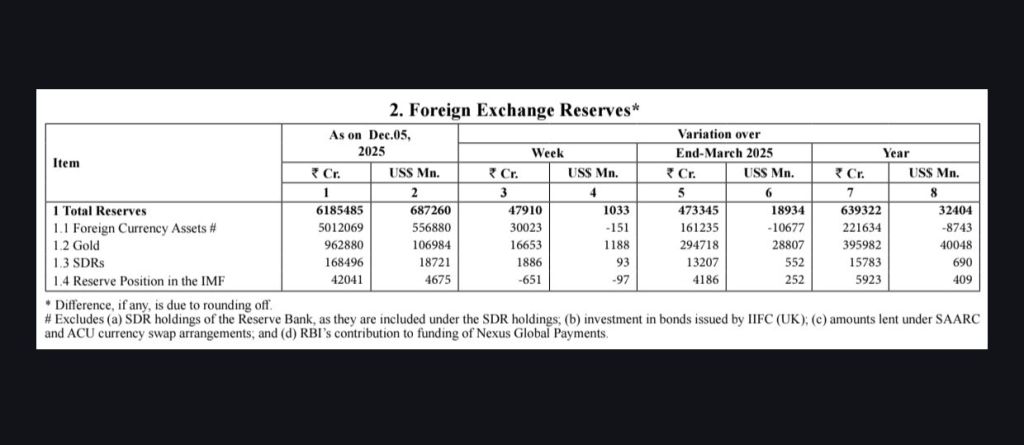

In 2022 when Russia invaded Ukraine, America threatened with sanctions on oil, coal, energy etc. The nations which had import relations with Russia were told to cut off trade relations. In short their money supply was broken. This move made the world realise that money wise we are slaves of America. A global trend started where Central Banks started buying gold. Russia, India, China topped the charts. As per the Foreign Exchange Reserves data, the Reserve Bank of India have significantly increased gold reserves during the period 2022 to 2025. This is the main reason for the global gold price bull run. The world has started to shift the dependence from US dollars.

The supremacy of the dollar is decreasing because of less use of dollars in international trade and financial transactions. The Central Bank across the world is seeing a sharp decline in US dollar reserves. The US treasury is seeing a sharp decline in transactions. Euro, British Pound Sterling, Japanese Yen, Chinese Yuan are majorly used to settle trade transactions. Trump’s campaign of making America great again (MAGA) focuses on increasing money flow in the country by imposing trade sanctions. The final goal is to maintain the position of US dollars in the global forum.

Leave a comment